What's in a Credit Score?

Ah, credit scores. Just about everyone has one (and if you are over the age of 18, and you don’t have a credit score, we need to talk), but does anyone really know what goes into that score? If your credit score is just a number on a piece of paper to you, then you have come to the right place.

A credit score is a collection of financial figures that are unique to you. It is made up of your payment history, how much debt you have open, age of credit, how long you have been building credit and the types of accounts you have open.

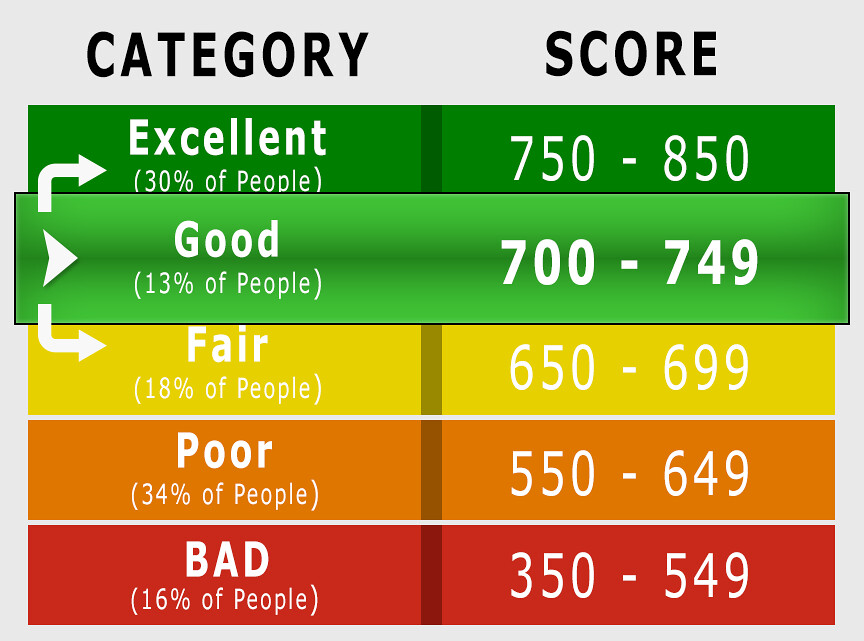

There are three different credit bureaus: Experian, Equifax, and TransUnion. While each bureau has its own algorithm to determine your score, they all operate the same way; the higher the number, the better your score is viewed by lenders. Experian, for instance, has a minimum 300 score and a maximum 850, but each bureau has its own range.

*Bonus tip: You can order your FREE credit report from each bureau every year. Order one every four months so you’ll always be on top of your credit report.

Let’s take a deeper look into the contributing factors that make up a credit score.

• Payment History – 35% of your overall score

This accounts for all of the payments you have made on debts that are reported on your credit. The more on-time payments you have, the better you will score in this category. If you’ve paid late, you guessed it, that’s going to drop that score a bit.

Were you surprised that this didn’t make up more of the credit score? While it does count for the majority of how the score is calculated, there’s more to consider. Let’s learn about the next factor.

• Amount Owed/Utilization – 30% of your overall score

This category is basically calculating how much of your credit limit are you using. So, let’s say you apply and are approved for a credit card with a $5,000 limit. If you then complete a balance transfer for $4,900, your utilization of that card is 98%, whereas a balance transfer for $1,500 will leave you with 30% utilization. The lower that utilization is, the better your score will look.

• Length of Credit History – 15% of your overall score

Are you new to the credit game, or have you been opening accounts since you turned 18? Accounts that have been opened the longest have the highest impact on your credit score whereas newer accounts haven’t had a chance to establish a pattern yet. So, while we don’t recommend paying those store charge card rates of 18% for the rest of your life, it might not hurt to use it once in a while and pay it off immediately before interest accrues. You’ll keep your credit history and save money. Just promise us that you’ll use a more competitive card for major purchases! Of course, we are partial to this one.

*Bonus tip: When you consolidate bills or close accounts, try not to close out your oldest pieces of credit because this can bring your score down.

• New Credit – 10% of your overall score

Picture this, you just bought a house and it needs a little love. You head to the hardware store and see that they offer a 0% rate on appliances for two years. You open the card, take advantage of the great discount and leave happy. On your way home, you stop by the furniture store. They also offer a deal that’s too good to pass up with no payments for 12 months and same as cash financing. You go ahead and pick out all the new furniture you need, saving yourself a ton of time and money. You’re on a roll, so you decide to book the electrician (plumber, painter, landscaper etc.) and pay them using your new credit card.

You just opened four (4) new accounts before you could blink an eye. For those of you who have been using credit for years and have a rich history of established accounts, this won’t hurt you as much. If you haven’t been using credit for very long, or are using newly established accounts, this is likely going to hit you hard.

• Credit Mix – 10% of your overall score

If you’re the type who wants to pay cash for everything, this is something you’re going to want to pay attention to. The credit mix refers to the types of credit you have. Credit bureaus want to see a wide variety of accounts in your history. This means the old store card you opened up 15 years ago isn’t really going to cut it. They want to see credit cards and other revolving debt, an installment loan, an auto loan, and a mortgage. This shows range and ability to pay back different types of debts.

*Bonus tip: Many creditors offer you the chance to check your score. Usually, this is located in your personal account (in your credit card statement or online banking). If you don’t have access to those features, Credit Karma is a free tool that can help you see your scores whenever you want them; although they may not be completely accurate, it is a good ball-park estimate for where you stand with creditors.

If this all sounds overwhelming, don’t stress! The great thing about credit reports is that small changes can have a huge impact. Furthermore, recent changes to legislation have made it even easier to rebuild credit.

What changed?

• Inquiries (applications)

Years ago, when you applied for a car, dealerships would send your credit application to groups of lenders. Customers would end up with 5 or 10 inquiries on their credit, which would significantly hurt their score. Now, all inquiries for the same purpose (buying a car, applying for a mortgage, etc.) are now being considered as one inquiry.

*Bonus tip: An inquiry doesn’t hurt you much if it is done infrequently. You want to avoid having multiple inquiries during a short period of time because those add up and knock your score down.

• Medical Collections

Have medial collections? You’re not alone. While they still affect your score, Equifax confirms that they are not weighed as heavily as other types of collection accounts and they do not report on your credit until after the 180-day mark.

So, why is it important to build good credit? The simple answer is that it affects virtually every aspect of your life – not just financially. Sure, a good credit score will earn you the best low rates for your loans and credit cards, but there is so much more than that.

• For instance, you don’t need credit just for buying something. Even if you want to rent an apartment, your credit will be checked. That means that good credit can save you from paying additional money up front or keep you from being turned away.

• Thinking of starting cable or satellite tv? If your credit is bad, you may need to think again.

• Shopping around for auto, life or homeowners insurance? Your credit will be pulled and factored into the rate you will be charged for protection.

• Changing employers?

A credit check is one of many steps during the employment process, so make a good impression with a good credit score. Some positions will even require that their employees maintain good credit. This is especially true in the field of finance and the military.

Establishing and maintaining good credit does not mean you will have to live a life full of debt, so don’t be afraid. Being smart and financially responsible with your money is always the most important part of financial literacy. Know what you can afford before you commit. There are calculators available to determine payment amounts, interest rate, loan amount and terms on loans – use them! Here’s our favorite for helping our members calculate personal loans.

Just because you have a credit card with a $5,000 limit, does not mean you should immediately go spend that much. When establishing or rebuilding credit, start small. Charge a couple of hundred dollars and pay that off over six months. You’ll get the benefit of an established account reported to your credit bureau without paying back a ton in interest and being burdened by debt. Remember – it’s a marathon, not a sprint. It takes a little bit of time to establish good credit, but now that you know how to do it, we hope it’ll be easier for you to take charge of your credit score today!

If reading all of that leaves you needing a vacation, you’ll love our next blog, “Summer Vacation Ideas That Won’t Break The Bank.”

Krista Kyte is a personal finance blogger and personal banker with over 17 years of experience in the financial industry. Krista is passionate about helping our members understand their financial situations. She writes tips that will help them reach and maintain financial security, and start living the life they’ve always wanted.